Techanic Infotech worked wonders for our luxury real estate business! They boosted our website visibility, attracted global buyers, and significantly improved our organic traffic. Their strategies are top-notch, and the results speak for themselves—highly recommend!

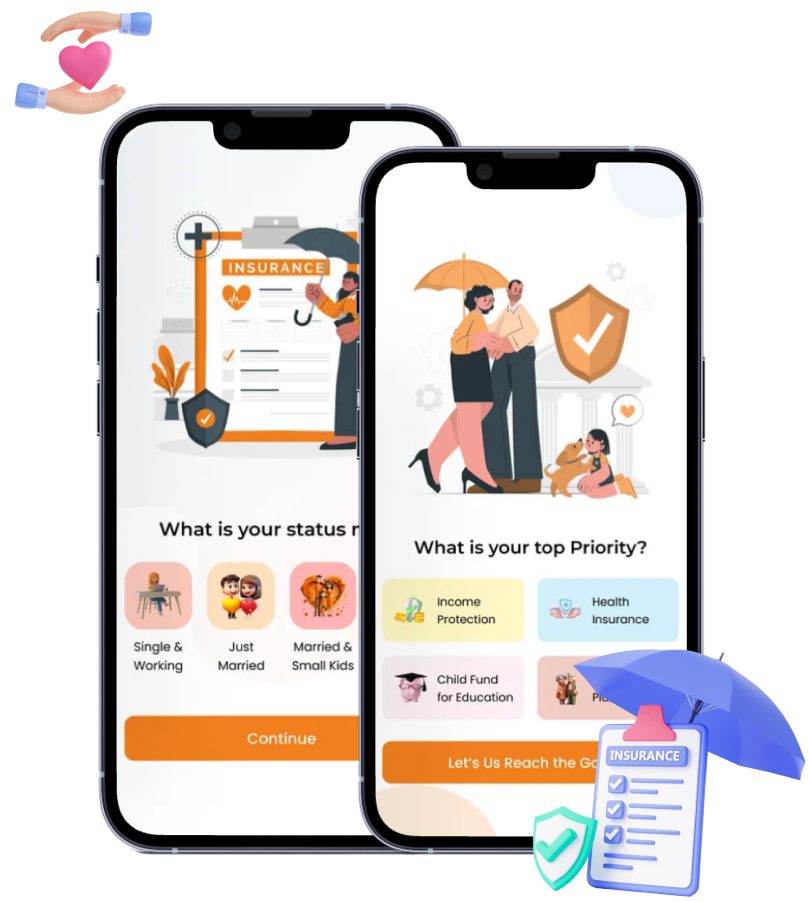

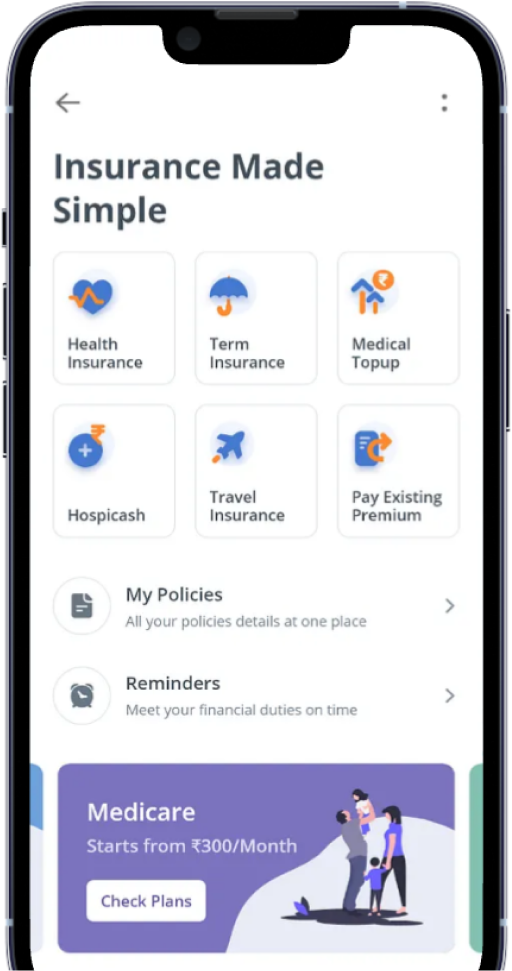

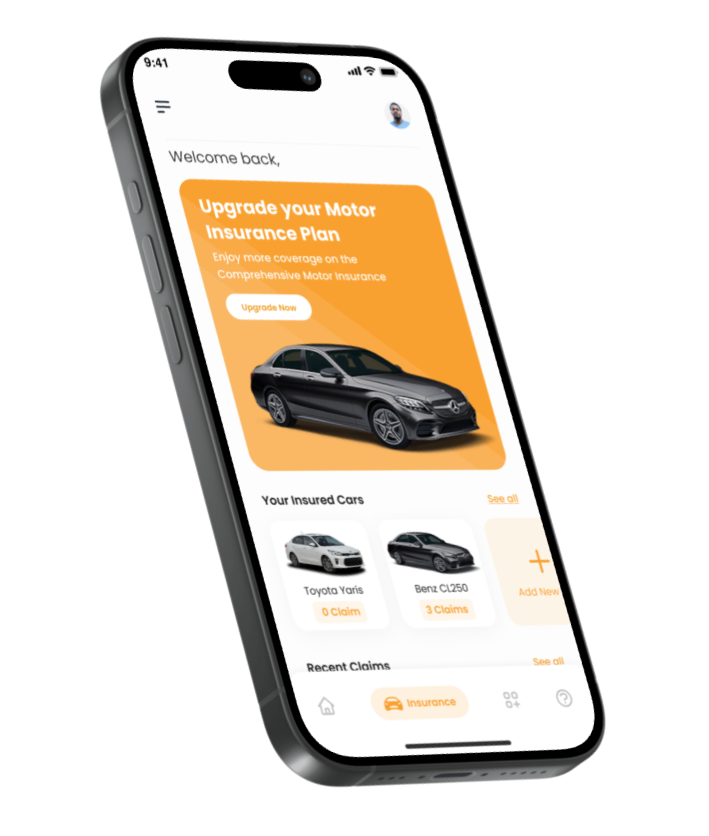

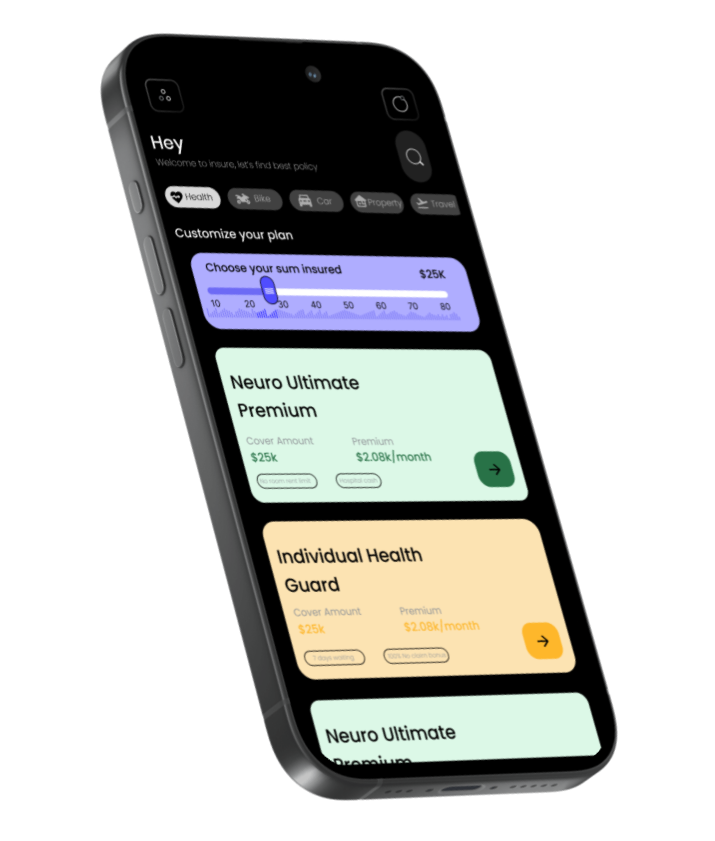

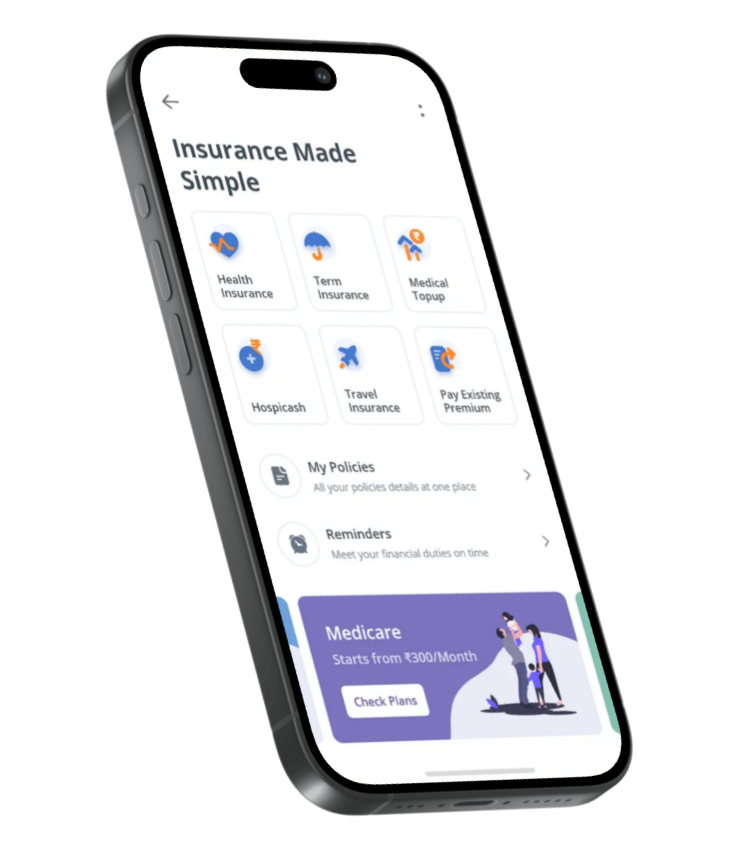

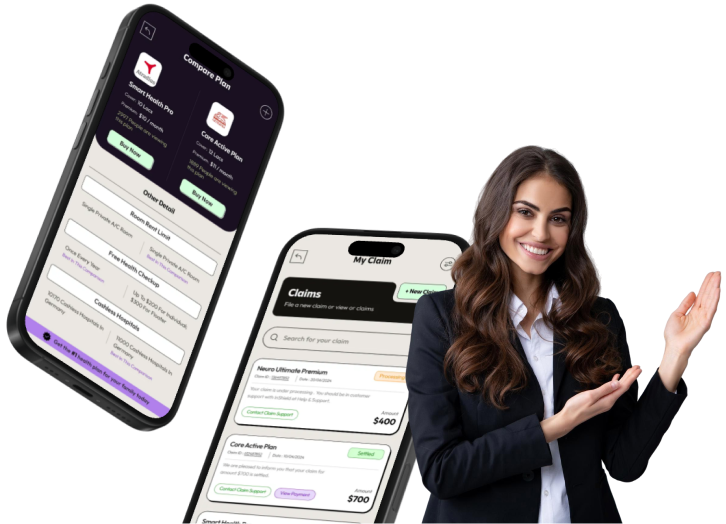

Insurance App Development Company

Custom insurance experiences need speed, clarity, and trust. As an on-demand insurance app development company, we create insurance app solutions that support delivery, automation, and customer control. Businesses can also hire insurance app developers to scale features as needs change.