eWallet App Maintenance Guide: Cost, Security Updates & Long-Term Support

January 6, 2026

January 6, 2026

The eWallet app is one of the most convenient ways to make digital payments.

The number of users relying on mobile wallets for transactions is increasing, and businesses need to ensure that these e-wallet apps remain secure and scalable for them.

This comprehensive guide helps by diving into the important aspects of eWallet app maintenance, focusing on cost implications, required security updates, and long-term support strategies.

It's essential to thoroughly understand the factors that support developers in planning a reliable, secure, and cost-effective app.

This blog helps to explore how routine updates protect against emerging threats by improving functionality.

Technology choices impact both development speed and long-term maintenance costs. Frontend technologies like React Native or Flutter enable faster development while maintaining quality.

Cloud infrastructure from AWS, Google Cloud, or Azure adds $500-$3,000 monthly for hosting and services.

Payment gateway integration varies by provider. Stripe costs $500-$1000 to integrate, while custom payment solutions can exceed $300-$700.

PCI-DSS compliance requires extensive security audits and implementations, costing $100-$400 initially. Annual maintenance and re-certification add $500-$1500 yearly.

Technic infotech considered one of the best app development company provide affordable maintenance charges for the eWallet app.

Developing an eWallet app by following proper ways, considering the top features helpful in making the best or safe application for users.

With growing numbers of mobile wallets, developers need to properly implement multiple security measures to save sensitive details.

The following are the key features in ewallet apps that deliver a secure platform for users.

In-short, two-factor authentication ( 2FA ) adds an extra layer of security by requiring some details from the users to verify their identity, like inputting their password and something like one time password, whether it's OTP or fingerprint.

This approach helps reduce the chances of any unauthorized access, even if login credentials are compromised.

Implementing the 2 factor authentication that allows only authorised users to transfer the money.

( Example: "After introducing two-factor authentication, PayPal saw a 30% decrease in unauthorized account access, significantly improving customer satisfaction and trust.")

End-to-end encryption, like fingerprint and entering the OTP with facial recognition allow users to keep their data safer by offering a more reliable and secure method for getting access to their eWallet apps.

With E2EE, sensitive information such as payment details or personal data is unreadable to anyone except the intended recipient.

This prevents hackers from accessing sensitive information during transmission, protecting users from data breaches or man-in-the-middle attacks.

( Example: "A leading mobile wallet provider, Apple Pay, upgraded its encryption protocols in 2019 and reported a 40% drop in fraudulent activities.")

Biometric authentication, such as fingerprint scanning or facial recognition, offers a quick, reliable, and secure way to access eWallet apps.

Unlike traditional passwords, biometric data is unique to the user and nearly impossible to replicate, reducing the risk of unauthorized access.

This feature provides a frictionless yet highly secure login experience, enhancing both convenience and protection.

( For instance Fingerprint and facial recognition technologies in apps like Google Pay have revolutionized user convenience and security. After integrating biometric authentication, user logins increased by 15%, and security breaches decreased by over 50%.)

Real-time transaction alerts notify users immediately about any activity on their accounts.

These alerts can be configured for every transaction, including deposits, withdrawals, or transfers.

Such notifications act as an early warning system for any unauthorized or suspicious activities, enabling users to take prompt action and report potential fraud before significant damage is done.

Integrating a secure payment gateway is crucial for ensuring that transactions are processed safely.

Trusted payment gateways use advanced security protocols, such as Secure Socket Layer (SSL) or Transport Layer Security (TLS), to encrypt transaction data.

By leveraging this eWallet app tech stack, eWallet apps can protect users from fraud or interception during payment processing, enhancing the overall safety of financial exchanges.

( Example: "After integrating secure payment gateways like Stripe, a small fintech company reported a 20% boost in customer confidence and an increase in transaction volume." )

Ensuring compliance with data privacy regulations such as GDPR or CCPA is essential for any eWallet app.

This guarantees that user data is handled responsibly, with transparency in how it is collected, stored, and used.

Adhering to privacy laws also protects the app from legal issues, ensuring that users’ sensitive information is not exploited or misused.

eWallet app maintenance plays an important role in ensuring the consistent performance, security, and user trust on the platform.

Based on industry case studies, most of the businesses are investing in regularly maintaining the overall experience with higher user retention and fewer security incidents.

The following are the key reasons that show the importance of eWallet app maintenance.

Regular eWallet app maintenance helps detect and resolve bugs, crashes, and performance issues at an early stage.

Continuous monitoring and optimization improve app speed and transaction processing efficiency.

In real-world usage, well-maintained apps handle high transaction volumes smoothly, minimize eWallet app development timeline, and deliver a consistent experience, which directly reduces negative reviews and improves user retention.

Cybersecurity threats evolve rapidly, especially in financial applications.

Routine maintenance allows developers to patch vulnerabilities, update encryption protocols, and fix security loopholes.

Case studies show that eWallet apps receiving regular security updates experience fewer data breaches and fraud incidents, helping businesses protect sensitive user information and maintain long-term trust.

Mobile operating systems and devices are frequently updated with new versions and features.

Ongoing maintenance ensures the eWallet app remains fully compatible with the latest OS updates, screen sizes, and APIs.

This prevents functionality issues, crashes, or login failures, ensuring users can access the app smoothly across all supported devices.

Post-launch user feedback often reveals navigation challenges in eWallet app development, slow processes, or design inconsistencies.

Regular maintenance enables continuous UI/UX improvements, feature enhancements, and usability refinements.

By addressing real user pain points, businesses can improve engagement, increase transaction frequency, and deliver a smoother, more intuitive eWallet experience.

Financial regulations and data protection laws frequently change across regions.

Ongoing eWallet app maintenance ensures compliance with standards such as data privacy, transaction security, and financial reporting requirements.

Staying compliant reduces legal risks, prevents penalties, and strengthens user confidence in the app’s reliability and credibility.

( Example: "For instance, a popular eWallet app in 2020 suffered a data breach due to outdated encryption. The company then adopted a robust maintenance schedule, resulting in fewer security issues and a 25% reduction in fraud incidents.")

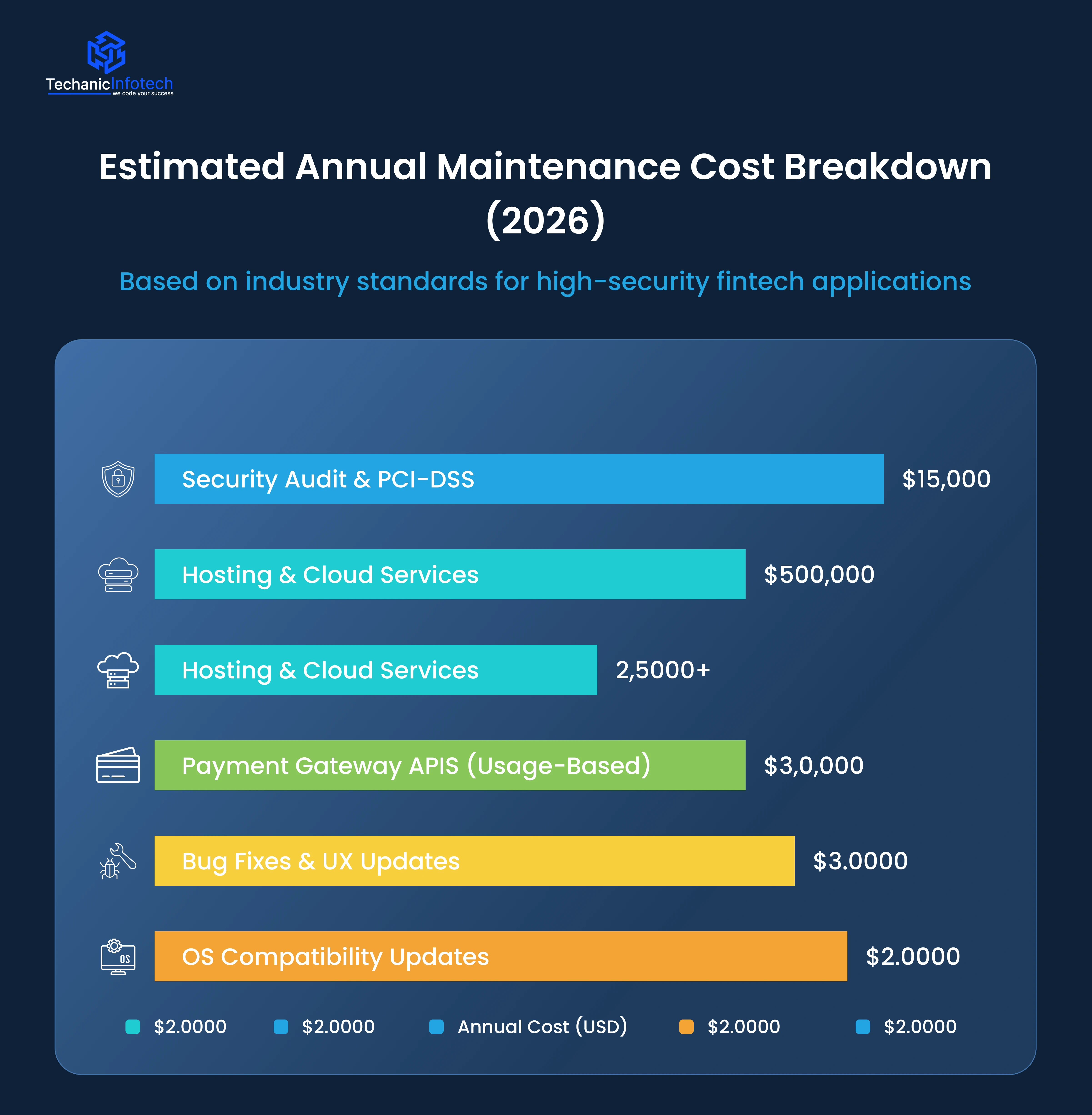

Understanding the eWallet app maintenance cost is essential for businesses planning to launch a secure and scalable digital payment solution.

While the initial development investment covers design, features, and integrations, many overlook the ongoing expenses required to keep the app stable, compliant, and competitive.

Beyond the upfront eWallet app development cost, regular maintenance ensures smooth performance, strong security, and compatibility with evolving operating systems and regulations.

Factors such as server infrastructure, third-party services, security updates, and customer support all contribute to annual maintenance expenses.

The table below breaks down these maintenance costs to help you plan an accurate and realistic budget.

|

Maintenance Area |

Estimated Annual Maintenance Cost |

Description |

|

App Maintenance (Annual) |

15%–20% of the initial development cost |

Covers bug fixes, performance optimization, and minor feature updates |

|

Server & Hosting |

$200 – $800/month |

Cloud hosting, storage, bandwidth, and scalability costs |

|

Security & Compliance |

$300 – $500/year |

PCI-DSS, KYC, AML updates, audits, and data protection |

|

Third-Party APIs |

$100 – $500/year |

Payment gateways, SMS, push notifications, analytics |

|

App Updates & OS Compatibility |

$200 – $600/year |

iOS/Android version updates and device compatibility |

|

Customer Support & Monitoring |

$500 – $800/year |

Issue tracking, uptime monitoring, and support tools |

|

Fraud Detection & Prevention |

$200 – $600/year |

Fraud monitoring systems, transaction analysis, and risk management |

|

Database Maintenance & Optimization |

$100 – $600/year |

Database tuning, backups, indexing, and performance improvements |

|

Disaster Recovery & Backup |

$100 – $700/year |

Data backups, recovery planning, and failover systems |

|

Feature Enhancements |

$300 – $800/year |

Adding new features based on user feedback and market trends |

( For Example: A startup fintech company with a $35,000 eWallet app spent about 15–20% annually on maintenance, covering hosting, security, API services, and updates. In contrast, a bank-backed eWallet with a $50,000+ development cost required higher maintenance due to advanced security, fraud detection, multi-currency support, and scalable cloud infrastructure.)

eWallet app security is paramount in protecting users' financial data and preventing fraud. Regular security updates are crucial to maintaining trust and ensuring safe transactions.

Here are the key updates eWallet apps need:

Regular updates to encryption protocols such as AES and RSA ensure that sensitive information, like credit card details and personal data, remains protected during transactions. Strong encryption keeps data secure from cyber threats.

To prevent unauthorized access, eWallet apps should integrate multi-factor authentication (MFA), including biometric verification (fingerprints, face recognition) and two-factor authentication. This provides an additional layer of security for users.

Payment gateway security updates reduce the risk of fraud and ensure secure online payments. Updated payment systems are essential to combat evolving security threats and offer a safe user experience.

Regular bug fixes and security patches are necessary to address vulnerabilities in the app. Security patches help eliminate potential attack points that hackers could exploit.

AI-driven fraud detection systems should be regularly updated to monitor suspicious activities and prevent fraudulent transactions, keeping the app secure.

eWallet apps need to comply with privacy regulations like GDPR and CCPA. Security updates should include compliance with data protection laws to safeguard user privacy and avoid legal issues.

Techanic Infotech is a trusted eWallet app development company for businesses looking to develop high-performance eWallet applications that are secure, scalable, and user-centric.

With deep expertise in fintech solutions, the company focuses on building eWallet apps that deliver fast, reliable, and seamless digital payment experiences.

Whether you are launching a new digital wallet or upgrading an existing platform, Techanic Infotech ensures a future-ready solution tailored to your business goals.

The team implements secure payment systems with multi-layer protection, including advanced encryption, secure APIs, and multi-factor authentication.

In addition to security, Techanic Infotech prioritizes user experience and functionality. The apps are designed with intuitive interfaces that make payments, money transfers, and bill payments effortless.

To achieve lasting success in the highly competitive mobile wallet market, an eWallet app must strongly prioritize security, user experience, and scalability.

Regular security updates help protect against emerging cyber threats, while an intuitive and user-friendly interface improves customer satisfaction and retention.

Advanced features such as fast and seamless payments, real-time alerts, rewards, and loyalty programs significantly boost user engagement.

Additionally, strict adherence to financial regulations and data privacy laws builds trust and ensures long-term compliance.

Partnering with an experienced development team like Techanic Infotech delivers a robust, secure, and future-ready eWallet solution that evolves with user expectations, market demands, and the latest technological and security advancements.

Security is critical in eWallet apps as they manage sensitive financial data. Without strong security features like encryption and multi-factor authentication, users' funds and information can be compromised.

Security updates should be made frequently, ideally monthly, or sooner if vulnerabilities are detected. Regular updates help maintain app security and safeguard user information.

Key features include fast transactions, a user-friendly interface, multi-currency support, real-time notifications, and strong security with encryption and MFA.

Yes, many eWallet apps are designed to handle both personal and business transactions, offering features like invoicing, bulk payments, and accounting system integration.

Top eWallet apps comply with global financial regulations like GDPR and PCI DSS to ensure data privacy and secure transactions. Regular updates help keep apps compliant.