Key Takeaways

P2P payment apps thrive on simplicity and trust, making secure transactions, fast transfers, and an intuitive user experience essential for long-term adoption.

Strong security and compliance are non-negotiable, including encryption, KYC, fraud detection, and adherence to financial regulations from day one.

Feature selection impacts cost and scalability, so prioritizing core payment features first helps control development time and budget.

Flexible monetization models drive sustainability, such as transaction fees, premium features, or merchant integrations, without harming user experience.

Choosing the right development partner matters, as expert guidance ensures a secure, scalable, and future-ready P2P payment app.

Building a digital payment solution has become a smart move as users increasingly prefer fast, secure, and cashless transactions.

A peer-to-peer payment platform allows users to send and receive money instantly using their smartphones, without relying on traditional banking processes.

If you’re planning to build a P2P payment app, it’s important to understand the technology, security requirements, compliance standards, and user expectations involved.

From choosing the right features to ensuring seamless user experience and fraud protection, every step matters. This guide takes you through the complete development journey, explaining key stages, best practices, and strategic decisions.

Whether you’re a startup founder or an enterprise, this step-by-step approach will help you create a scalable, user-friendly, and future-ready P2P payment application that stands out in a competitive fintech market.

A P2P (peer-to-peer) payment app allows users to send and receive money directly from their mobile devices without needing cash or physical bank visits.

These apps are widely used for splitting bills, paying friends, or making quick transfers. Understanding how they function is essential before learning how to build a Peer-to-Peer Payment App that users can trust.

Users sign up using their phone number or email and complete identity verification.

The app securely links a bank account, debit card, or digital wallet.

A sender selects a contact, enters the amount, and confirms the payment.

The app encrypts transaction data and routes it through a secure payment gateway.

Funds are transferred instantly or within a short settlement period.

Both sender and receiver get real-time notifications for the transaction.

Behind the scenes, strong security protocols, compliance checks, and backend APIs ensure transactions remain fast, accurate, and protected.

The P2P payment app market is growing rapidly as consumers shift toward cashless transactions and mobile wallets.

With faster transfers, improved security, and wider smartphone adoption, many startups now see this space as a strong eWallet app idea with long-term potential.

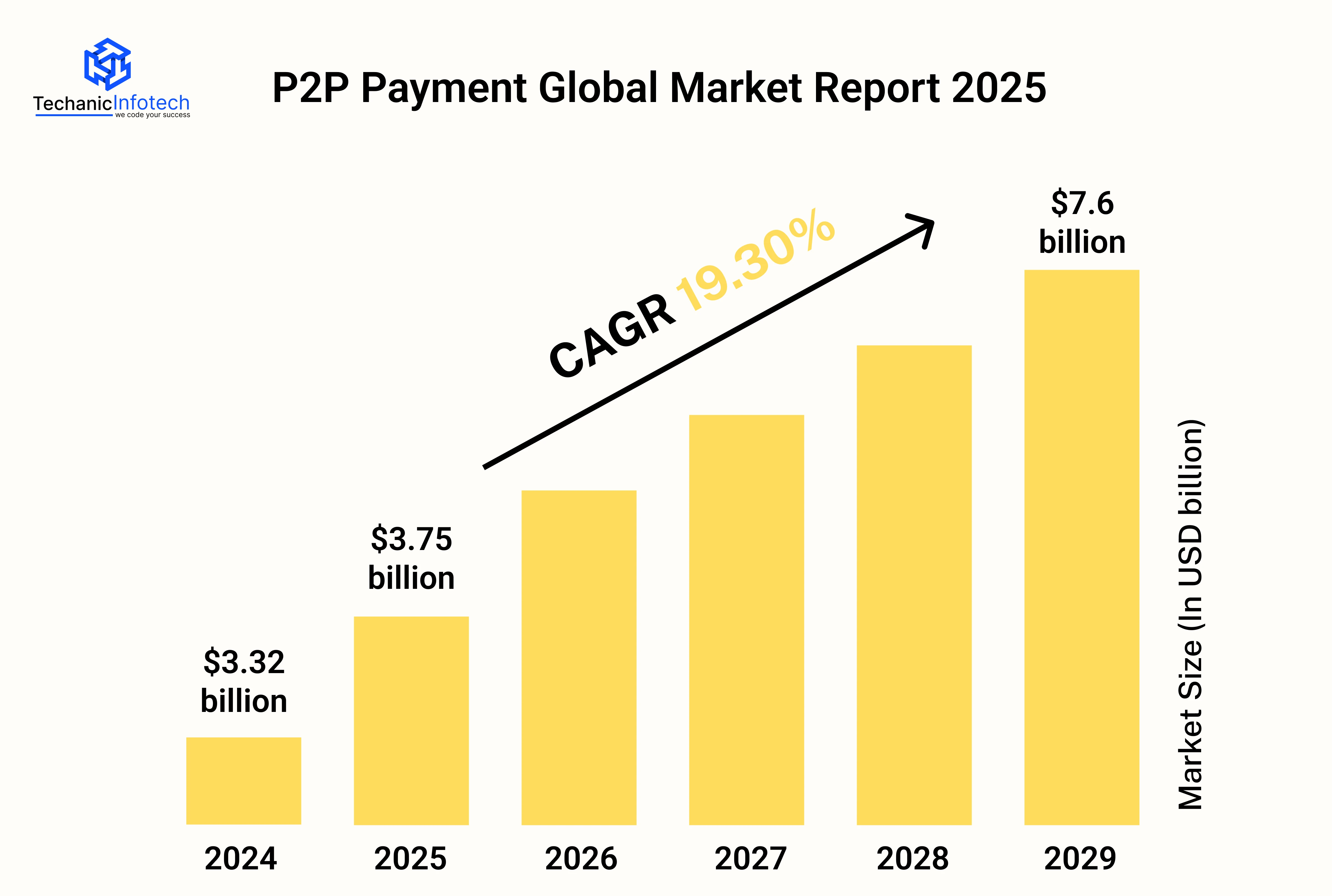

Below are key market statistics that highlight the scale and momentum of the global P2P payments industry.

The global P2P payment market is expected to grow from $3.32 billion in 2024 to $3.75 billion in 2025, reflecting steady year-over-year expansion.

Market forecasts estimate it could reach $7.6 billion by 2029, growing at a CAGR of approximately 19%.

Mobile-based P2P payments account for nearly 87% of total transactions, proving that mobile apps dominate this segment.

Cross-border P2P transactions increased by over 45%, driven by demand for low-cost international transfers.

The global P2P payment market reached approximately $3.1 trillion in transaction volume in 2024, with forecasts showing continued double-digit growth through the next decade.

There are several types of P2P payment apps designed to meet different user needs, from instant transfers to global remittances.

Understanding these categories helps businesses choose the right model, features, and monetization strategy before development. Below are five common types of P2P payment apps widely used today.

These apps connect directly with users’ bank accounts, enabling fast and secure money transfers without holding wallet balances.

Users can send or receive funds using phone numbers or email IDs. Examples include apps backed by major banks that focus on trust, compliance, and real-time settlements.

Mobile wallet apps allow users to store money digitally and make instant peer-to-peer payments.

They support bill payments, QR-based transactions, and in-app rewards. With evolving e-Wallet app trends, these platforms now integrate cashback offers, loyalty points, and seamless checkout experiences.

These apps combine payments with social interaction. Users can send money alongside messages, emojis, or shared expenses.

Social features improve engagement and retention, making these apps popular among younger audiences who value convenience and interaction.

Designed for international transfers, these apps support multi-currency payments with lower fees than traditional banking systems.

They are ideal for freelancers, immigrants, and global businesses. Building such platforms requires strong compliance, security layers, and expertise in P2P Payment app development.

These apps enable users to pay individuals and small businesses from a single platform. They often include invoicing, transaction history, and analytics tools.

If you plan to create a mobile app for payments, this model works well for expanding into B2C and B2B use cases.

To succeed in today’s competitive fintech space, a P2P platform must offer speed, security, and convenience.

Every P2P payment app feature should focus on trust, ease of use, and seamless transactions. Below are seven essential features that define high-performing peer-to-peer payment apps and keep users engaged.

A smooth onboarding process is critical when you want to create an app like PayPal. Users should be able to sign up using their email address, phone number, or social login credentials. Multi-factor authentication, biometric login (Face ID or fingerprint), and OTP verification add an extra security layer while keeping access fast and simple.

Users expect instant connectivity with their bank accounts and debit or credit cards. Secure APIs enable seamless linking, deposits, and withdrawals. This feature supports real-time transfers and boosts trust, especially among first-time users exploring digital payments.

A built-in wallet allows users to store funds, view balances, and track transactions easily. Strong eWallet app development ensures fast load times, accurate transaction history, and smooth fund management, making the app more reliable for daily use.

Fast peer-to-peer transfers are the core of any payment app. Users should be able to send or receive money instantly using phone numbers, QR codes, or usernames. Real-time notifications help confirm successful transactions and reduce confusion.

Clear and detailed transaction records help users stay in control of their finances. Filters for date, amount, and recipient improve usability, while downloadable statements add extra value for personal or small business use.

To build a P2P payment app users can trust, security must be non-negotiable. Features like end-to-end encryption, AI-based fraud detection, tokenization, and real-time alerts protect sensitive financial data and prevent unauthorized activity.

Reliable support builds long-term credibility. In-app chat, help tickets, and FAQs help resolve issues quickly. Clear dispute resolution workflows also guide users on how to make a P2P payment app that prioritizes user confidence and satisfaction.

Building a secure and scalable P2P payment solution requires a clear roadmap, technical precision, and a strong focus on user trust.

This process to create a Peer-to-Peer app outlines the essential steps businesses should follow to design, develop, and launch a successful payment platform.

Start by identifying the primary purpose of your P2P payment app. Decide who your target users are and what problems the app will solve.

At this stage, list essential eWallet app features such as instant transfers, wallet balance, transaction history, and security layers. Clear goals help avoid scope creep later.

Analyze popular P2P apps to understand user expectations, monetization models, and feature gaps. Research helps you identify differentiators, pricing strategies, and compliance standards. This step ensures your app offers real value instead of copying existing platforms.

Selecting the right eWallet app tech stack is crucial for performance and security. Decide whether you want native or cross-platform development.

Focus on scalable backend frameworks, encrypted APIs, and reliable cloud infrastructure to handle high transaction volumes.

A smooth UI/UX eWallet design directly impacts adoption. Design a simple interface that allows users to send and receive money in just a few taps.

Clear navigation, minimal steps, and visual trust indicators improve engagement and reduce drop-offs during transactions.

The backend manages transactions, user authentication, and wallet balances. Implement strong encryption, tokenization, and secure databases.

This step ensures data integrity, fast processing, and smooth communication between users and payment gateways.

Connect your app with banks, cards, and digital wallets. API integration enables real-time fund transfers, balance checks, and transaction confirmations. Reliability and speed are key here to maintain user confidence.

Before release, perform rigorous testing including functional, security, and performance testing. Fix bugs and optimize speed.

Once ready, launch the app on the App Store and Google Play Store with proper descriptions, screenshots, and compliance documentation.

After launch, monitor performance and user behavior closely. Use analytics to optimize features and server load. This phase focuses on how to develop a peer-to-peer payment app that scales smoothly as user numbers grow.

Stay compliant with financial regulations such as KYC, AML, and data protection laws. Regular security audits and updates protect users and maintain platform credibility over time.

Continuous improvement is essential. Add new features, enhance UX, and optimize performance based on feedback. This final step ensures you develop a app like Google Play that remains competitive, secure, and future-ready.

The estimated cost to build a P2P payment app typically ranges from $20,000 to $150,000+, depending on features, platform, security standards, and development complexity.

Understanding the eWallet app development cost upfront helps businesses plan budgets and choose the right development approach.

Below is a clear breakdown of the P2P Payment app cost based on key factors.

|

App Type |

Estimated Cost |

Features Included |

|

Basic P2P App |

$20,000 – $50,000 |

User login, wallet, basic transfers |

|

Mid-Level App |

$50,000 – $90,000 |

Bank integration, notifications, security layers |

|

Advanced App |

$90,000 – $150,000+ |

AI fraud detection, analytics, and multi-currency |

Each component plays a crucial role in delivering a secure and reliable user experience.

|

App Component |

Description |

Estimated Cost (USD) |

|

UI/UX Design |

User flow, wireframes, visual design, and usability testing |

$5,000 – $15,000 |

|

Frontend Development |

User interface for iOS/Android apps |

$10,000 – $30,000 |

|

Backend Development |

Server logic, databases, APIs, and core app functionality |

$15,000 – $40,000 |

|

Payment Gateway Integration |

Secure payment processing, bank APIs, and transaction handling |

$8,000 – $20,000 |

|

User Authentication & Security |

KYC, encryption, OTP, biometric login |

$6,000 – $15,000 |

|

Admin Panel Development |

Dashboard for managing users, transactions, and reports |

$5,000 – $12,000 |

|

Third-Party API Integration |

SMS, email, analytics, fraud detection |

$3,000 – $10,000 |

|

Testing & Quality Assurance |

Manual and automated testing across devices |

$4,000 – $10,000 |

|

App Deployment & Setup |

App Store & Play Store submission and configuration |

$2,000 – $5,000 |

|

Maintenance & Updates (Annual) |

Bug fixes, security updates, feature upgrades |

$5,000 – $20,000 |

Several elements directly impact the overall mobile app development cost:

App complexity (basic, mid-level, or advanced)

Platform choice (iOS, Android, or cross-platform)

Security & compliance (PCI-DSS, KYC, AML)

Third-party integrations (payment gateways, banks, APIs)

UI/UX design quality

Development team location

Apps with real-time transfers, biometric login, and fraud detection naturally cost more.

Choosing the right monetization models is critical to building a profitable and scalable P2P platform.

When you create an app like Venmo, revenue doesn’t usually come from basic peer-to-peer transfers but from value-added services layered on top.

Below are the most effective monetization models used in modern Peer-to-Peer mobile wallet development.

Many P2P apps charge small fees on specific transactions rather than everyday transfers.

Instant bank transfers or same-day withdrawals

Cross-border or international payments

Business or merchant payments

This model keeps user-to-user payments free while generating a steady income from premium transactions.

Offering paid plans unlocks advanced features for power users.

Higher transfer limits

Faster settlements

Enhanced security controls

Subscription revenue works well when paired with financial tools, making it a reliable option in any guide to P2P payment app development.

When users pay businesses through the app, platforms can charge merchants a small commission.

Point-of-sale integrations

QR-based payments

In-app checkout options

This approach turns the app into a business payment ecosystem while keeping personal transfers free.

P2P apps connected to debit or prepaid cards earn interchange fees on card usage.

In-store purchases

Online transactions

ATM withdrawals

This model generates passive revenue as users rely on the app for daily spending.

Advanced financial features can unlock additional revenue streams.

Currency exchange services

Microloans or credit options

Investment or savings tools

These services increase user retention while expanding monetization beyond payments.

Non-intrusive ads and partnerships can boost revenue without hurting user experience.

Sponsored offers from financial brands

Cashback deals and rewards

Partner-driven promotions

When implemented carefully, ads complement the core payment experience rather than disrupt it.

Building a peer-to-peer payment platform involves more than just enabling money transfers.

When businesses plan to develop a P2P eWallet app, they face technical, regulatory, and user-experience challenges that must be addressed early.

Below are five major challenges commonly encountered during P2P payment app development, along with practical one-line solutions for each.

Security is the biggest concern in any financial app. P2P payment apps handle sensitive user data, bank details, and transaction histories, making them prime targets for fraud, data breaches, and unauthorized access.

Weak encryption, poor authentication methods, or delayed fraud detection can damage user trust permanently.

Solution: Implement multi-layer security with end-to-end encryption, biometric authentication, and real-time fraud monitoring.

P2P apps must comply with financial regulations such as KYC, AML, PCI-DSS, and regional data protection laws. Missing compliance requirements can lead to legal penalties, app removal from stores, or restricted operations, especially when scaling across regions.

Solution: Work closely with legal experts and integrate compliance checks from the earliest development stage.

Users expect fast onboarding, smooth navigation, and instant payments. Complex registration flows, delayed verification, or confusing interfaces can increase drop-offs. Understanding how to make a P2P payment app user-friendly is crucial for adoption.

Solution: Design a clean UI/UX with minimal steps, clear prompts, and quick verification processes.

Users demand real-time or near-instant transfers. Payment failures, delays, or integration issues with banks and gateways can hurt reliability and user satisfaction, especially during peak usage times.

Solution: Partner with reliable payment gateways and optimize backend architecture for high-volume transactions.

As user numbers grow, the app must handle higher transaction loads without downtime. Poor scalability planning can result in crashes, slow performance, and increased maintenance costs when the platform expands.

Solution: Build a cloud-based, scalable infrastructure that supports future growth without performance loss.

Techanic Infotech supports businesses at every stage of building a secure and scalable P2P payment app.

As an experienced eWallet app development company the team focuses on security-first architecture, smooth user experience, and regulatory compliance from day one.

From ideation and feature planning to UI/UX design and backend development, every step follows industry best practices.

Techanic Infotech integrates advanced security layers such as encryption, secure APIs, fraud detection, and compliance-ready frameworks to protect user data and transactions.

The development process is transparent, agile, and tailored to your business goals.

Backed by a proven guide to P2P payment app development, the team ensures your app is reliable, future-ready, and built to scale with growing user demand.

Building a secure, scalable, and user-friendly digital payment solution requires the right strategy, technology, and execution.

A well-planned approach helps you handle security, compliance, performance, and user trust from day one. From understanding user needs to choosing the right features and monetization model, every step plays a key role in long-term success.

If you’re planning to build a P2P payment app, focus on seamless UX, strong encryption, regulatory compliance, and future-ready architecture.

Partnering with an experienced development team can simplify complex challenges and speed up time to market.

With the right roadmap and technical expertise, your P2P payment app can stand out in a competitive fintech landscape and deliver real value to users.

A P2P payment app lets users send and receive money instantly using mobile devices. It connects bank accounts, cards, or wallets, making everyday payments, bill splitting, and transfers fast, secure, and convenient.

Building a P2P payment app usually takes 4–6 months, depending on features, security layers, compliance needs, and integrations. Advanced apps with fraud detection and scalability can take longer.

The cost to build a P2P payment app typically ranges from $20,000 to $120,000. Pricing depends on app complexity, platforms, security standards, third-party APIs, and development location.

Essential security features include data encryption, two-factor authentication, fraud detection, secure APIs, and compliance with financial regulations. These measures protect user data and build trust in payment transactions.

Yes, a P2P payment app can scale with cloud infrastructure, modular architecture, and optimized APIs. Planning scalability early ensures smooth performance, faster transactions, and reliable service as user demand increases.