Bahrain has positioned itself as a strong fintech hub in the Middle East. With high smartphone penetration and government-backed digital initiatives, the country offers the perfect environment for mobile wallet solutions. Users today prefer apps that are simple, secure, and accepted everywhere, from supermarkets to taxis.

That’s why many businesses and startups are looking to create a digital wallet like BenefitPay. However, developing such an app is not just about payments. It involves compliance, security, scalability, and user trust.

In this blog, we’ll break down everything you need to know to build a digital wallet like BenefitPay, step by step, using simple language and real-world understanding.

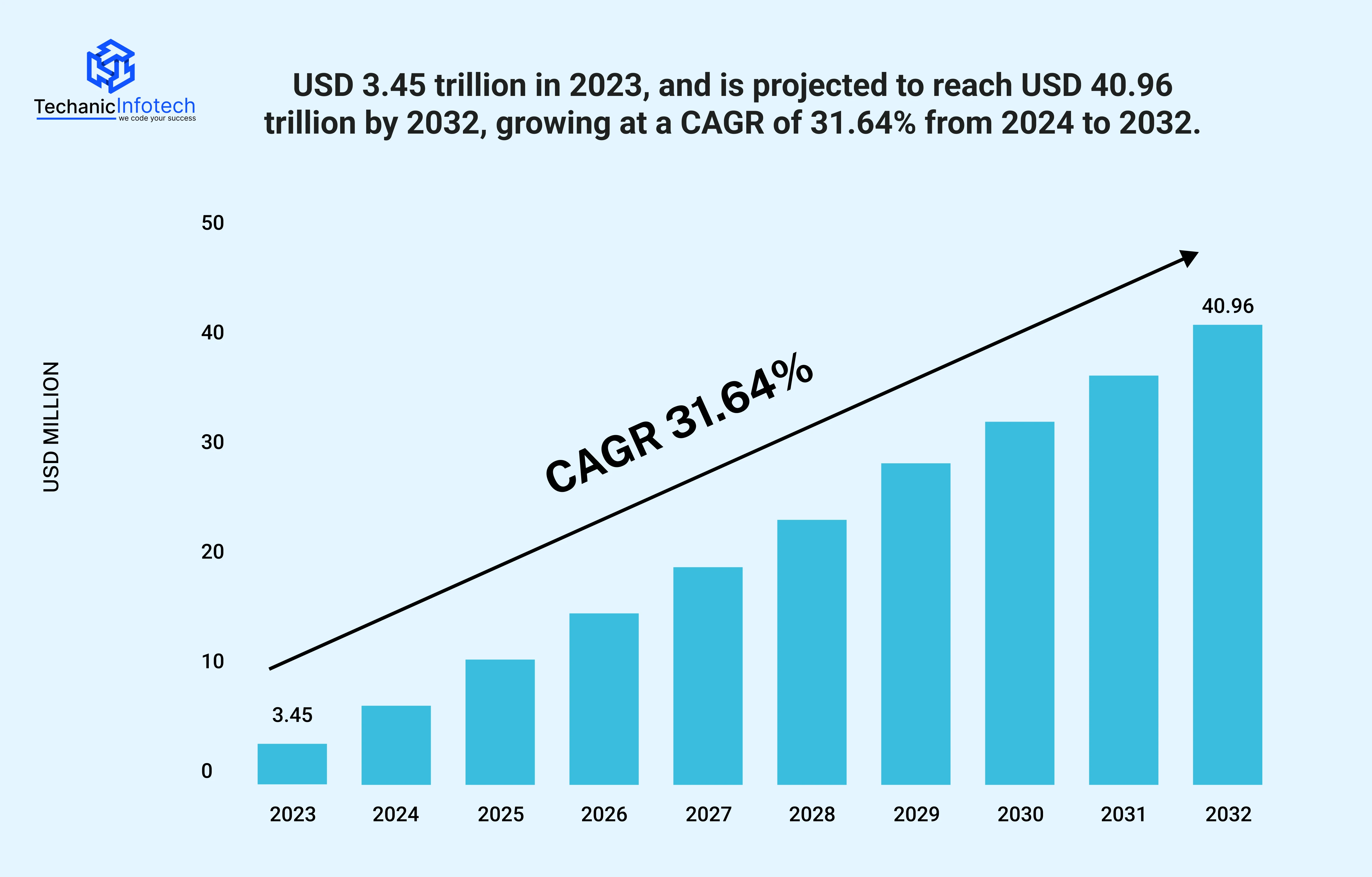

Here’s a snapshot of how digital wallets are shaping the global and Bahrain payment landscape with real, up-to-date figures and trends you should know before planning to start an ewallet business:

By 2025, digital wallets are expected to reach about 4.8 billion users worldwide, meaning more than half of the world’s population will use a wallet regularly for payments and financial transactions. This reflects rapidly rising comfort with cashless and mobile payments.

In 2024, global digital wallets processed an estimated US $10 trillion in transactions, and that number is projected to keep climbing as consumers and merchants increasingly prefer digital over cash or cards.

The overall global mobile payment market, led by digital wallets, is valued at USD 3.45 trillion in 2023 and is forecasted to grow to nearly USD 41 trillion by 2032, highlighting how dominant mobile payments are becoming.

The Bahrain digital payments market (which includes mobile wallets like BenefitPay) is valued at approximately USD 1.3 billion, driven by high smartphone adoption (over 99% internet penetration and 140% mobile connectivity) and supportive government cashless initiatives.

The digital payments market across the Middle East and North Africa is projected to grow from about USD 248 billion in 2025 to over USD 420 billion by 2030, reflecting strong demand for cashless and wallet-based payment solutions like BenefitPay.

These trends show why mobile wallets are no longer a future trend, they’re now mainstream finance tools. Users worldwide and in Bahrain are moving away from cash and cards and trusting secure, instant digital payment systems more than ever.

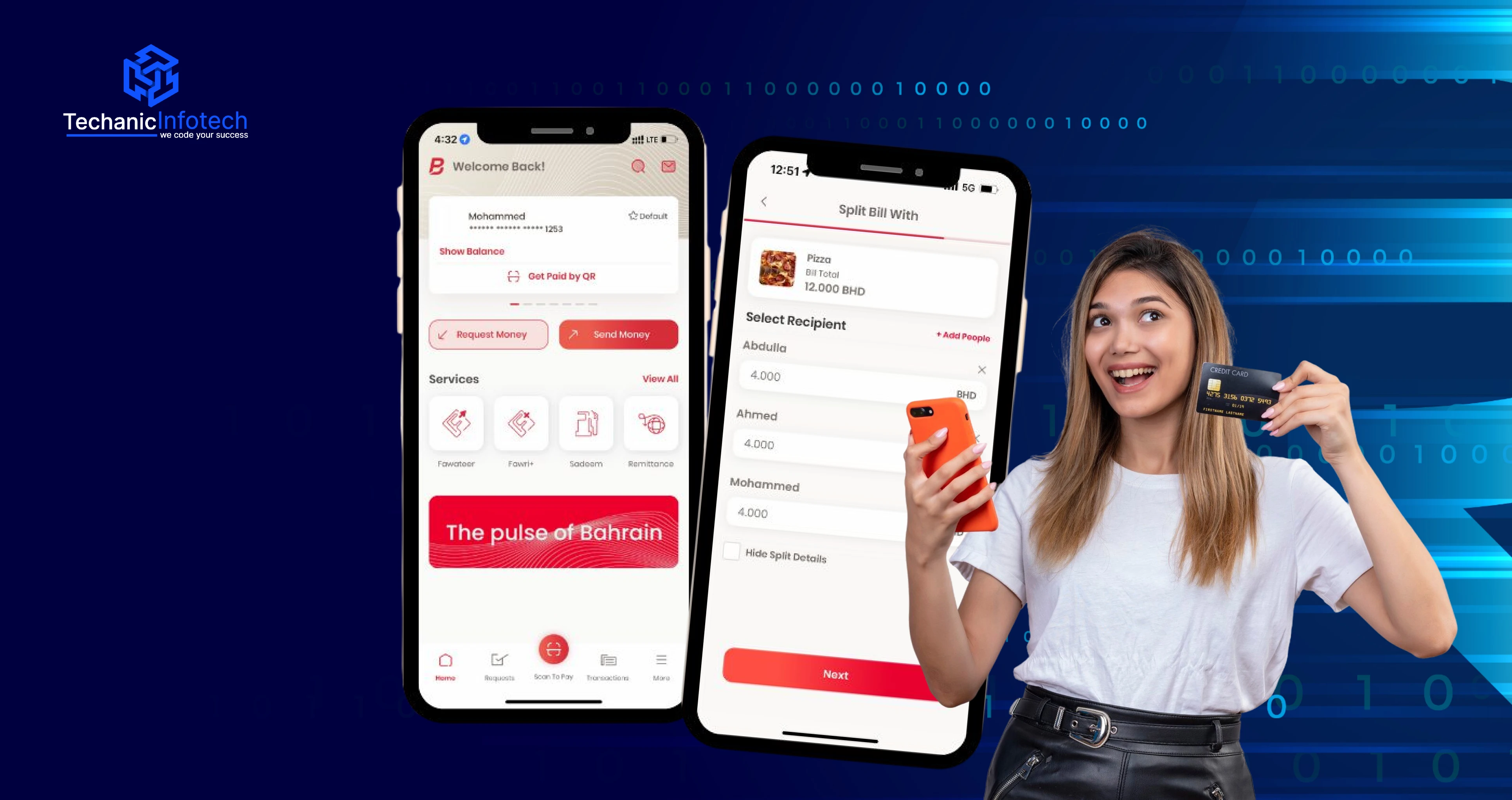

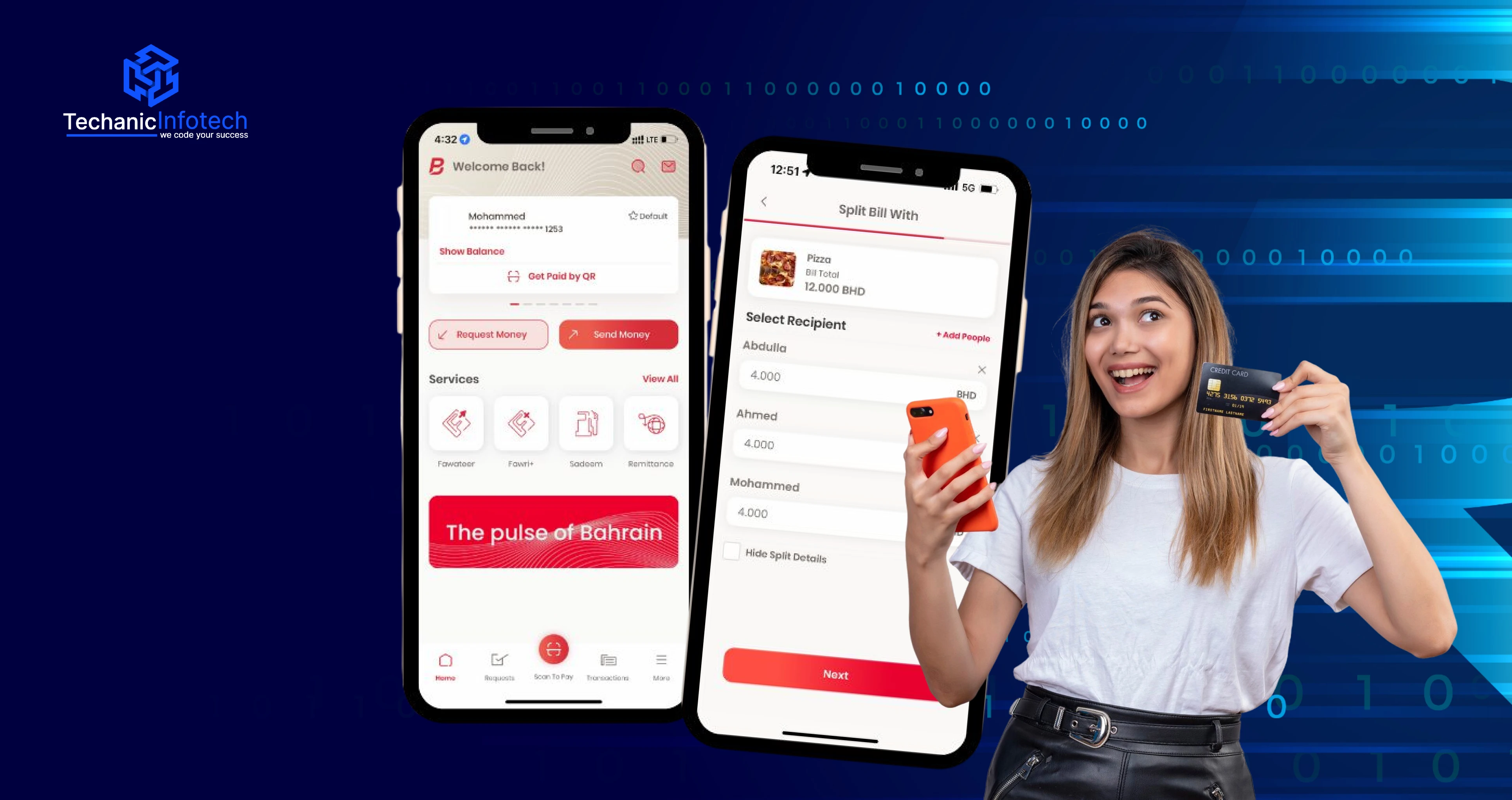

BenefitPay is Bahrain’s leading digital wallet payment platform that lets users make fast, secure, and convenient transactions right from their smartphones.

It is developed by The BENEFIT Company, a major financial infrastructure provider in the Kingdom, making it deeply integrated into Bahrain’s banking ecosystem and widely accepted across merchants and services nationwide.

With BenefitPay, people no longer need to carry physical cash or cards.

Instead, they can:

Link their bank accounts or debit/credit cards

Make instant transfers

Scan QR codes at stores

Pay bills

Split payments with friends

Top up services like fuel and utilities

All these features are bundled into one secure and easy-to-use mobile app that runs on both Android and iOS.

What sets BenefitPay apart from many traditional wallet apps is how seamlessly it works with the Bahrain financial ecosystem.

Since it ties directly with the national payment network and local banks, transactions are fast, reliable, and compliant with strict regulatory standards. This has made it not just an app, but a trusted part of Bahrain’s everyday payment habits.

Nationwide Acceptance: BenefitPay is widely accepted at retailers, restaurants, service providers, and online merchants across Bahrain, making it practical for daily use.

Ease of Use: Signing up and linking bank accounts is quick, and users can start transacting in minutes with minimal steps.

Secure & Regulated: The platform follows strong security standards and is regulated by Bahraini financial authorities, which boosts user confidence.

Instant Peer-to-Peer Payments: Sending money to friends and family using just a phone number or QR code is fast and free, increasing daily engagement.

Versatile Payment Options: Users can pay bills, buy fuel, split bills with friends, and even send digital gift cards—all from one app.

Government & Merchant Integrations: Integration with government services and kiosks makes it useful beyond shopping, like paying bills and fees seamlessly.

Because of these strengths, BenefitPay has grown into a trusted payment platform in Bahrain that millions rely on every day.

BenefitPay isn’t just another wallet app, it’s a full-fledged digital payment ecosystem designed for ease, security, and everyday use.

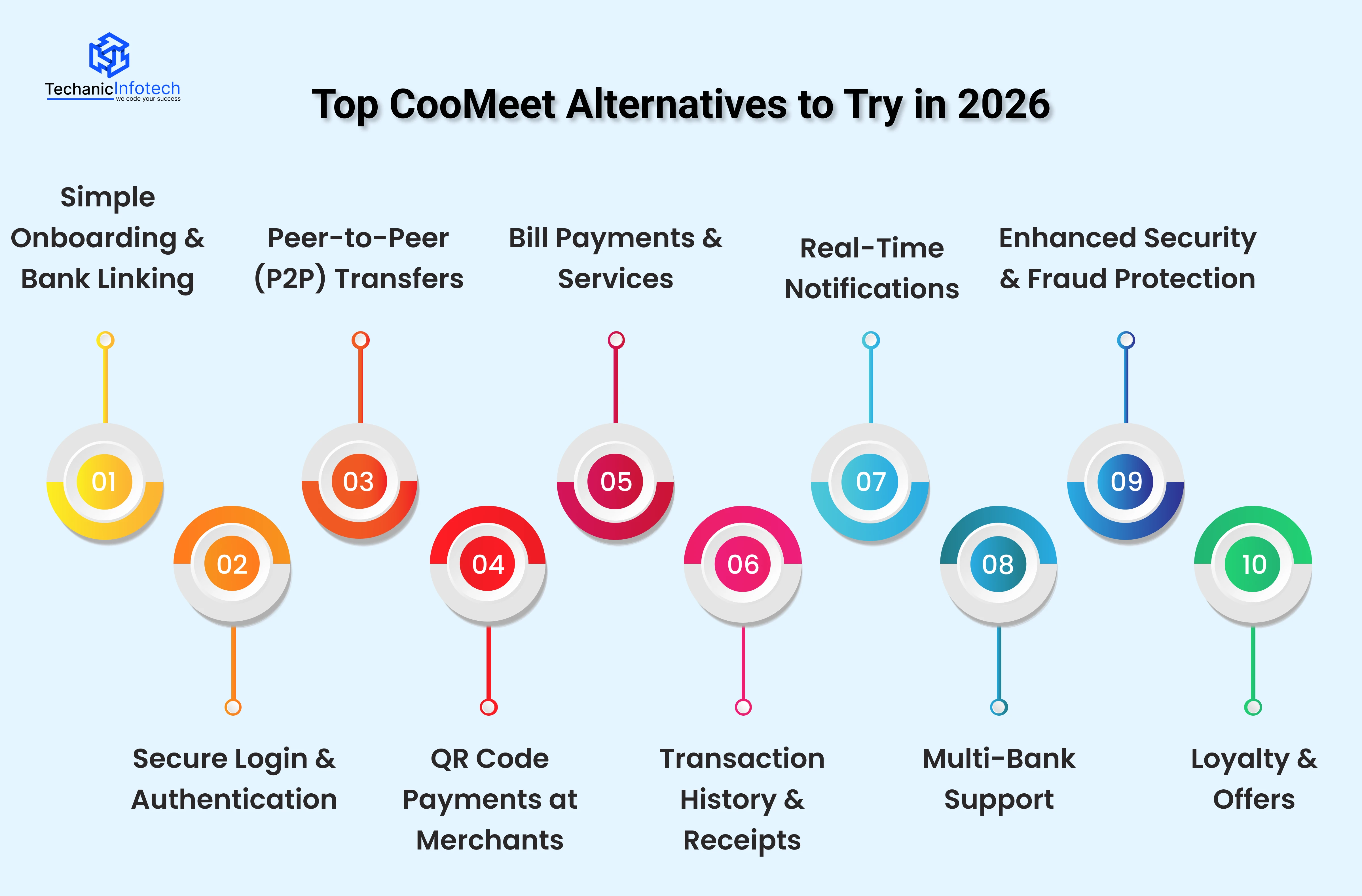

Below are the main ewallet app features that make it both powerful and user-friendly:

Users can quickly register with their mobile number and link their bank accounts or cards with a few easy steps. It removes the friction of lengthy sign-ups and gets users transacting faster.

BenefitPay uses secure PINs and optional biometric login (fingerprint or face ID) to protect accounts. This ensures only authorized users can access and transact.

Sending money to friends and family is effortless. Users can transfer funds using a phone number, QR code, or just from their contact list, all instantly and with minimal steps.

The app’s core payment method is QR scanning. Users simply scan the merchant’s QR code, enter the amount (if required), and pay in seconds. No cash, cards, or terminals needed.

BenefitPay supports utility bill payments, government fees, and service bills directly within the app. Users get details and confirmation instantly.

Every transaction, whether payment or transfer, is recorded. Users can view history, download receipts, and track spending easily.

Push notifications alert users instantly for payments sent, received, or any account activity, enhancing clarity and trust.

Instead of being tied to one bank, BenefitPay connects with multiple Bahraini banks, making it accessible to a wider audience.

The app employs encryption, fraud monitoring, and secure gateways to protect sensitive data and prevent unauthorized transactions.

Users sometimes get access to exclusive discounts, cashback, and partner deals, encouraging engagement and repeat use.

Together, these features make BenefitPay a complete and reliable digital wallet, fast, secure, and suited for everyday Bahrain life.

Building a digital wallet like BenefitPay is not just a technical project, it’s a business decision that requires planning, compliance, and a strong focus on user trust.

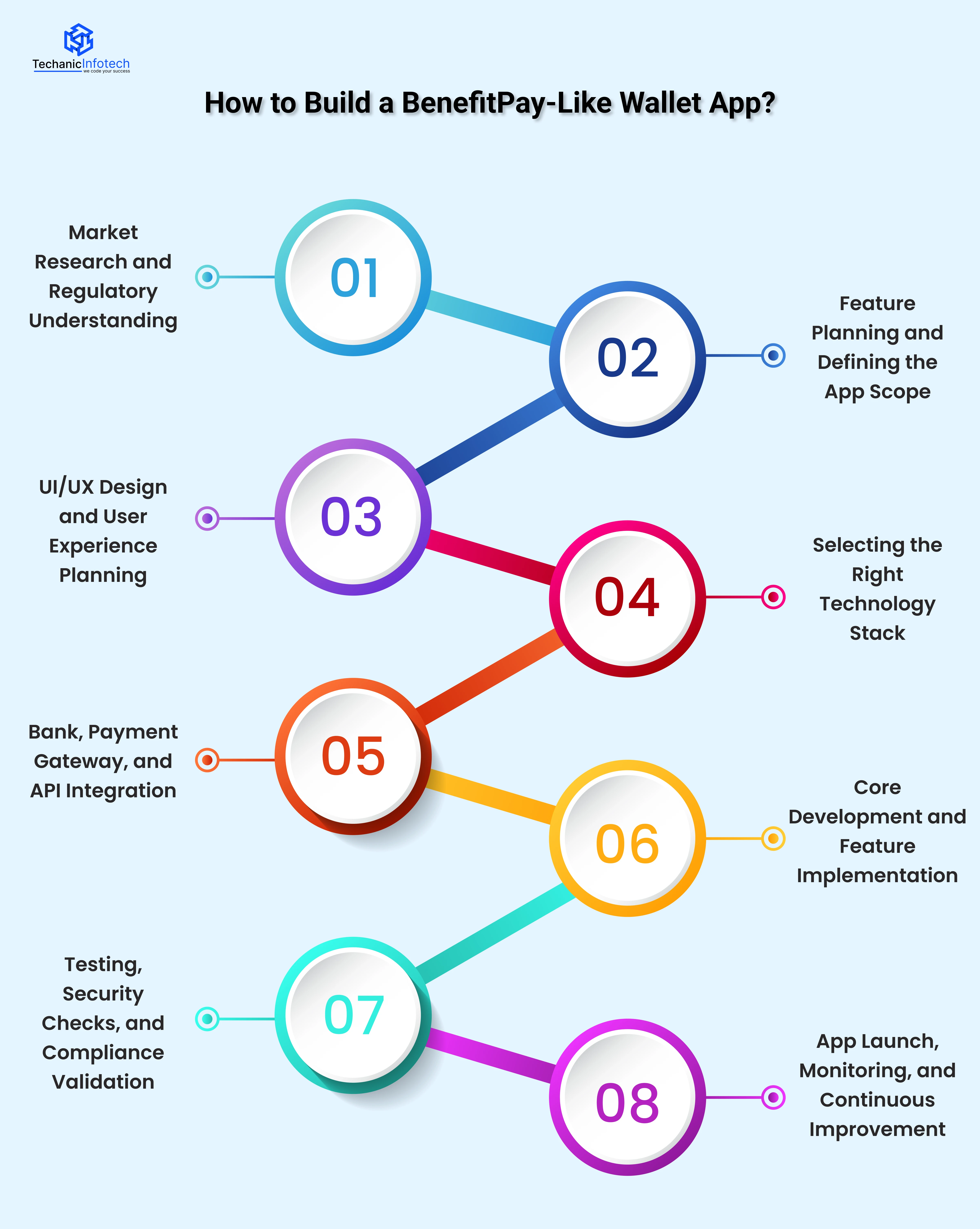

Below is a detailed, easy-to-understand breakdown of each eWallet app development process, along with tips and benefits to help you avoid common mistakes.

When you plan to build a digital wallet like BenefitPay, the first and most important step is understanding the market and the regulatory environment in Bahrain.

Digital payments in the country are governed by strict financial rules, and any fintech product must align with local compliance standards.

This stage focuses on studying how users in Bahrain make digital payments, what they expect from wallet apps, and why platforms like BenefitPay have gained trust. Proper research also helps businesses plan BenefitPay app development in Bahrain in a way that matches both user needs and regulatory requirements.

Why this step matters: This phase reduces legal risks and ensures your wallet app can launch without regulatory roadblocks.

Tip: Involve legal and fintech advisors early to avoid rework later.

Once the groundwork is complete, the next step is to clearly define what your wallet app will offer.

To create a digital wallet like BenefitPay, you must identify essential features such as user onboarding, bank account linking, peer-to-peer transfers, QR payments, and transaction tracking.

This stage plays a major role in shaping digital wallet app development like BenefitPay, as it determines how complex, scalable, and user-friendly the app will be.

Careful planning also supports long-term eWallet app development in Bahrain by keeping costs and timelines under control.

Why this step matters: Well-defined features prevent scope creep and unnecessary mobile app development costs.

Tip: Focus on must-have features first and expand based on user feedback.

Design is a key factor in user adoption, especially when building a mobile wallet app in Bahrain for a wide age group. At this stage, the focus is on creating a clean, simple, and intuitive interface that allows users to complete transactions in just a few steps.

To develop a digital wallet like BenefitPay, the app must feel trustworthy and easy to use from the first interaction. A strong eWallet app design approach also supports fintech wallet app development in Bahrain by improving user confidence and reducing errors during payments.

Why this step matters: A smooth user experience increases engagement and encourages repeat usage.

Tip: Keep screens minimal and test designs with real users before finalizing them.

After finalizing the design and features, the next step is choosing the right ewallet technology stack to support your wallet app. This stage defines how fast, secure, and scalable your application will be.

To develop a digital wallet like BenefitPay, you need a strong backend for handling transactions, a reliable frontend for smooth user interaction, and cloud infrastructure that can handle growing traffic.

The technology choices you make here directly impact performance, security, and future upgrades, especially when planning long-term BenefitPay-like wallet app development.

Why this step matters: A strong mobile app tech stack ensures your app performs well even during high transaction volumes.

Tip: Always choose technologies that allow easy upgrades and third-party integrations.

This step focuses on connecting your wallet app with banks, payment systems, and QR-based transaction services. Secure ewallet API integration allows users to link bank accounts, send money, receive payments, and view transaction updates in real time.

This stage is critical for fintech wallet app development in Bahrain, as payment accuracy and security are non-negotiable. Proper integration also ensures that transactions are processed smoothly without delays or failures, which is essential when you aim to make a digital wallet like BenefitPay.

Why this step matters: All wallet functionality depends on secure and reliable integrations.

Tip: Test APIs thoroughly under real-world conditions before moving to the next phase.

Once integrations are ready, full-scale development begins. Developers start building the user dashboard, payment flows, admin panel, security layers, and notification systems.

This phase brings together mobile app design, features, and technology into a functional product.

During BenefitPay app development in Bahrain, special attention is given to encryption, data protection, and transaction validation to meet local compliance standards. Clean coding and modular development help keep the app stable and easy to maintain as it grows.

Why this step matters: This phase defines how smooth, fast, and reliable your wallet app feels to users.

Tip: Use modular development so features can be upgraded independently.

Once P2P payment app development is complete, the app must go through detailed testing before launch.

For a wallet app, this stage is especially critical because it deals with real money and sensitive user data. Testing covers functionality, performance, security, and user experience across different devices.

During this phase, teams check transaction accuracy, app speed, failure handling, and data protection measures.

In Bahrain, compliance validation is also required to ensure the app meets financial and regulatory standards before going live. Skipping or rushing this step can lead to serious trust and security issues after launch.

Why this step matters: Even small bugs or security gaps can cause financial loss and damage user trust.

Tip: Use both internal testing and third-party security audits for better reliability.

Launching the app is not the end of the journey, it’s the beginning of real-world usage.

After launch, the focus shifts to monitoring transactions, user behavior, app performance, and feedback.

This stage helps identify bugs, improve speed, and refine features based on how users actually interact with the app. Regular updates, security patches, and feature enhancements are essential for long-term success. Continuous improvement ensures the wallet app stays relevant, secure, and competitive as user expectations and market trends evolve.

Why this step matters: Ongoing monitoring helps maintain performance, security, and user satisfaction over time.

Tip: Track user feedback closely and release updates gradually instead of making large, risky changes.

Building a digital wallet app like BenefitPay involves multiple stages, each with its own cost and timeline. The total ewallet app development cost can vary significantly depending on features, security requirements, third-party integrations, and the development team’s location.

On average, digital wallet development projects fall in the $20,000 to $100,000+ range, with basic wallets costing less and fully featured solutions requiring more investment.

Below is an estimated breakdown of costs and timelines for fintech and mobile wallet app development, including features such as secure login, bank linking, QR payments, P2P transfers, and compliance support.

|

Development Stage |

Avg Cost (USD) |

Estimated Timeline |

|

Planning & Research |

$5,000 – $15,000 |

2–4 weeks |

|

UI/UX Design |

$7,000 – $25,000 |

4–8 weeks |

|

Core Development |

$40,000 – $120,000+ |

3–6 months |

|

API & Bank Integrations |

$10,000 – $30,000 |

4–8 weeks |

|

Security & Compliance Setup |

$8,000 – $25,000 |

4–10 weeks |

|

Testing & QA |

$5,000 – $20,000 |

2–6 weeks |

|

Deployment & Launch |

$2,000 – $8,000 |

1–2 weeks |

Note: These are ballpark estimates. A fully enterprise-grade wallet with advanced fraud detection, multi-currency support, AI features, or blockchain can exceed this range.

Budgeting for ongoing maintenance, legal approvals, and marketing is also important for long-term success of your wallet app.

Techanic Infotech is a trusted digital wallet app development company with strong experience in building secure, scalable, and user-friendly fintech solutions. Our team understands the technical, security, and compliance requirements involved in digital wallet app development, especially for markets that demand high trust and performance.

From idea validation to design, development, testing, and post-launch support, we handle the entire process with a clear and transparent approach. We focus on simple user experiences, strong security layers, and future-ready architecture that supports growth.

Whether you’re planning a wallet app inspired by BenefitPay or a custom fintech solution, Techanic Infotech ensures quality delivery, clear communication, and long-term technical support tailored to your business goals.

Building a digital wallet like BenefitPay in Bahrain is a promising opportunity, but it requires careful planning, strong security, and a clear understanding of local regulations.

From choosing the right features and technology to ensuring smooth user experience and compliance, every step plays an important role in success. A well-designed wallet app not only simplifies payments but also builds long-term user trust.

By following a structured development approach and focusing on reliability, scalability, and ease of use, businesses can launch a digital wallet solution that fits Bahrain’s growing cashless ecosystem and meets the expectations of modern users.

BenefitPay is a national digital wallet in Bahrain that allows users to make instant payments, transfer money, and pay bills directly from their bank accounts using a mobile app. It works through secure bank integrations and QR-based transactions.

On average, developing a BenefitPay-like wallet app takes 6 to 9 months, depending on features, compliance requirements, security layers, and third-party integrations.

Yes. Digital wallet apps must comply with regulations set by the Central Bank of Bahrain. Licensing, security audits, and compliance checks are essential before launch.

Core features include user registration, bank linking, P2P transfers, QR payments, transaction history, notifications, and strong security measures.

The cost usually ranges from $40,000 to $300,000+, depending on app complexity, security requirements, and integration needs.

Yes. With the right architecture and technology stack, wallet apps can be scaled to support more users, features, and transaction volume over time.

Security is one of the biggest challenges, as wallet apps handle sensitive financial data. Strong encryption, secure APIs, and regular audits are essential.

Absolutely. Businesses can add loyalty programs, offers, analytics, or additional payment options based on their goals and user needs.